The Percy Program

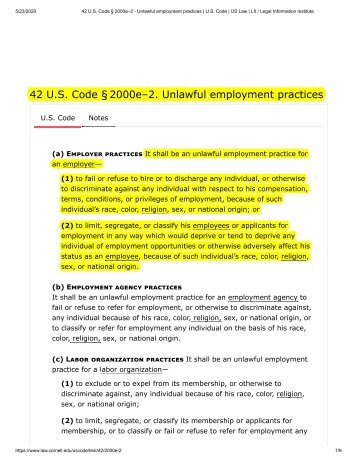

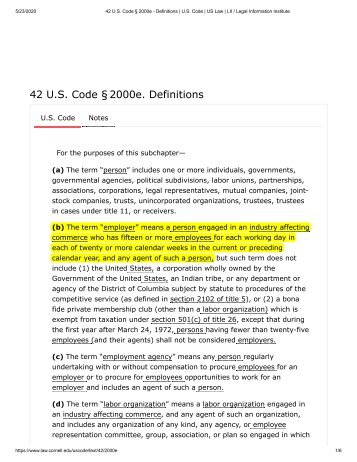

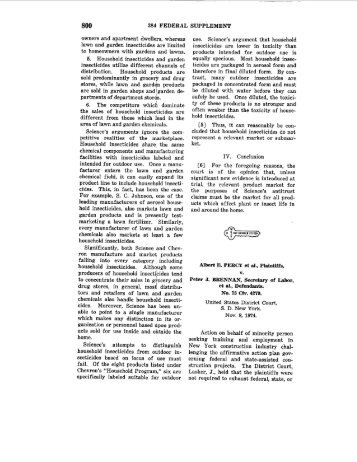

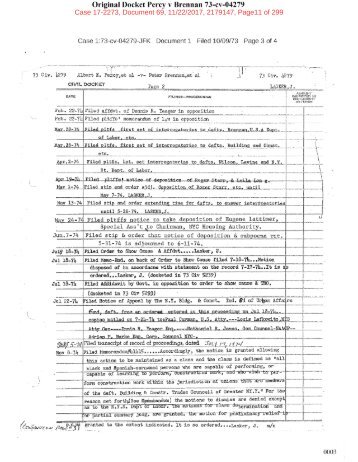

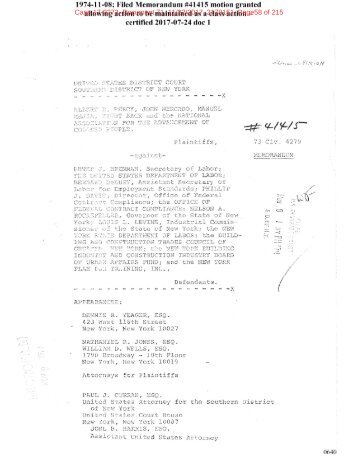

It is a fight to level the playing field to be able to compete for jobs and careers on the basis of skills and make available apprentice training to all. In 1973 Al Percy launched a class action lawsuit to give workers like him a chance to better their lot in life. It would also ensure the availability of skilled workers to build the infrastructure of the future.

Percy Program alternative employment practice, an IRC 501(c)(3) non-profit

- Text

- Percy

- Workers

- Compensation

- Apprenticeship

- Osha

- Assessment

- Coverage

- Items

- Programs

- Employment

Surety Bond Underwriting

Surety Bond Underwriting Each bond submission must contain the following: A. The last three years fiscal statements of the contractor. If the statement is more than six months old, an interim statement must be provided. B. Personal financial statements of the major stockholders as of the latest statement, fiscal or interim, whichever is most current. If the corporation is Sub-Chapter "S", the personal statement must tie into retained earnings of the business statement. C. Completed Indemnity Agreement - Principals, spouses and related companies. D. Completed Contractor's Questionnaire/Profile. E. Bank letter indicating line of credit, conditions and classification of account. F. Optional information, which would reference letters, awards from construction organizations, accountants’ info blank, etc. Upon receipt of the information, the underwriter would initiate the following: A. Review of the financial data in regard to format, liquidity, net worth, ratios, etc. B. Contact bank and suppliers for references. C. Check on completed job references and prior surety. D. Check the indemnity agreements to insure that signatures, seals and notaries are correct. E. Check collateral for proper form, signatures, etc Underwriting Files All underwriting files should be on at least a review basis, prepared in accordance with AICPA Guidelines with all necessary exhibits and should contain: 44 | Page

CLAIMS MANAGEMENT/ADJUSTMENT Claim adjustment will occur using the claim adjusting staff of the direct insurer, or by engagement of third-party administrators (TPA’s) to adjust that have been vetted for their competence and experience in adjusting workers’ compensation claims. The vetting process includes a review of the TPA’s methods used to train adjusters and nurse case managers to ensure they adhere to Percy’s Claims Handling Practices manual and applicable laws and regulations. Workers’ compensation TP As are paid on a per claim basis. Early Claim Reporting Early reporting of claims and responsive intervention will assist in reducing and managing the costs and responsive intervention will assist in reducing and managing the cost of work related injuries. When lag times between reporting and care are reduced, injuries are worsened by delay and downstream medical costs are thereby reduced. The resulting increased satisfaction of injured workers has a commensurate reduction in litigation costs. Case Management The objective of case management is to utilize the medical expertise disposal to manage and minimize medical costs and reduce lost time claims. Case management is integrated with the return to work philosophy and program outlined below. Utilization Management Utilization Management is performed where specialized testing, inpatient or outpatient hospitalization is required, or extensive physical or chiropractic regimens are required. The primary goal of Utilization Management is to efficiently manage and meet the medical needs of the injured employee. Utilization Management allows oversight of whether treatment is medically necessary, and whether the duration and course of treatment is appropriate. Medical Bill Processing Medical bills are reviewed for consistency and appropriateness as gauged against the state mandated fee schedules, preferred provider (PPO) discounts available under contract, and, where applicable, reasonable and customary charges. Medical bill review assists in the identification of potential fraud and double billing, and provides assurance that the employer and employee do not pay for bills that are not their responsibility. 45 | Page

- Page 1 and 2: Alternative Employment Practice JOB

- Page 3 and 4: TABLE OF CONTENTS TABLE OF CONTENTS

- Page 5 and 6: PERCY JOBS TO CAREERS PROGRAM The P

- Page 7 and 8: Purpose EXECUTIVE SUMMARY This Prog

- Page 9 and 10: ALTERNATIVE EMPLOYMENT PRACTICE The

- Page 11 and 12: ON THE JOB APPRENTICE TRAINING AND

- Page 13 and 14: OSHA, WORKER ASSESSMENT and TRAININ

- Page 15 and 16: testing process for ultrasonic, eff

- Page 17 and 18: for environmental conditions out of

- Page 19 and 20: safety standards, area specific saf

- Page 21 and 22: commercially-sterilized packages, d

- Page 23 and 24: utility, demolition, debris removal

- Page 25 and 26: install or remove Supported Scaffol

- Page 27 and 28: demonstrate that the Owner and work

- Page 29 and 30: eviews health effects caused by asb

- Page 31 and 32: claims history). Combined Fire Safe

- Page 33 and 34: Conduct Pre-work Hazard Assessments

- Page 35 and 36: and that all Contractors are in com

- Page 37 and 38: evaluator evidencing confidence in

- Page 39 and 40: • Total Estimated Policy Premium

- Page 41 and 42: The maximum amount that a multiple-

- Page 43 and 44: Surety bonding is a major obstacle

- Page 45: 2. Average annual payroll per emplo

- Page 49 and 50: PERCY PROGRAM ADMINISTRATION Admini

- Page 51 and 52: Check the wording and accuracy of e

- Page 53 and 54: ‣ Profitability: Given the import

- Page 55 and 56: CORPORATE HISTORY and STRUCTURE His

- Page 57 and 58: Labor Law Article 8 keep wages in t

- Page 59 and 60: SUMMARY Attached is a template poli

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...